PIN » Probability » Certainty |

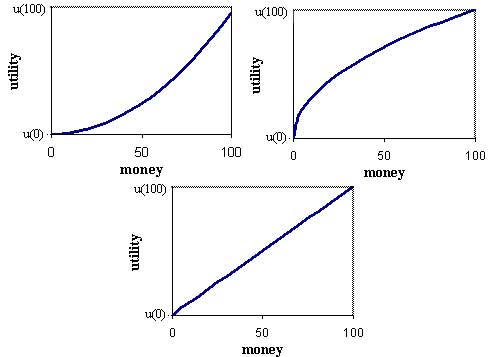

Why the shapes of the utility functions pictured above represent risk-seeking,

risk-aversion, and risk-neutrality can be made more clear by considering a

certainty equivalent (CE). A CE represents the maximum amount of money we

are willing to pay for some gamble. Alternately, a CE is the minimum premium

we are willing to pay to insure us against some risk. Imagine that I offer

you the following bet: I will flip a coin and if it lands heads you win nothing,

nut if it lands tails I award you $100. How much would you be willing to pay

for this chance? If I set up shop on a street corner and offer passerby this

gamble for $10, it is likely that most would take it. As I increase the price

to $20 and then $30 and $40, fewer and fewer people would accept. To see why,

consider the three utility functions below:

The first is a risk-seeker, the second is risk-averse, and the third is risk-neutral. In each case, the utility of winning $0 and the utility of winning $100 is denoted on the vertical axis. Since each outcome (heads and tails) is equally likely (1/2 chance), I am just as likely to get the happiness of $0 as I am of gaining the happiness of $100. This is expressed below:

My expected utility, or the happiness I expect to earn from this gamble on

average is half-way between my utility from winning $100 and my utility from

winning $0, since each is equally likely. The red line in each figure represents

the utility that this gamble will bring me, on average.

For the first person, the gamble between 0 and 100 dollars is worth about $75. This means that the person would be willing to pay me upto $72 for the right to win $100 based on a coin toss. Certainly, this is a "bad bet" since the average winnings are only $50. However, just like some are willing to make bad bets by playing the lottery or entering a casino, this person likes to take risks.

The second person would not be willing to pay anything over $25 dollars. Even though the coin toss, on average, pays $50, the extra risk is not worth it. This can be understood in the form of insurance. Consider a person with $100,000 net worth. Some accident, which has a 50% chance of happening, could cost the person his entire net worth. Therefore, this individual could end the year with a net worth of either $0 or $100,000. Because ending the year without any money is too great a risk, the person purchases insurance against the risk at a cost of $75,000. This way, he is certain to end the year at a net worth of $25,000 regardless of whether or not the accident occurs.

The third person is risk-neutral. Since the expected value of the bet is

$50 (1/2 chance at 0, 1/2 chance at 100), the person is willing to pay up

to $50 for the bet. This defines risk-neutrality - one is concerned only with

the actual expected value. These numbers ($75, $25, and $50) are called certainty

equivalents.

A certainty equivalent is the minimum amount of money I would rather have

for certain instead of taking some risk. The more risk-averse a person is,

the lower is her certainty equivalent.

Next : Misinterpretation of Probabilities

Previous : Risk