|

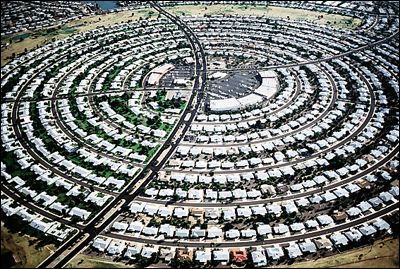

One of the most basic problems planners face is using existing resources to manage a growing population. More specifically, planners must decide where and how much land is used and what kind of infrastructure needs to be built on that land to increase the livable capacity of a region. Ewing characterizes some sprawl-like patterns which are often used to approach this problem such as large expanses of low density or single-use development, leapfrog or scattered development, and commercial strip development (Ewing 1997) . On the other end of the spectrum, more compact development patterns focus on minimizing land-use and building livable capacity through increasing the population density of a given place. Debates have raged (Ewing 1997; Gordon and Richardson 1997) as to whether sprawl is really something to be concerned about and whether, as an alternative, compact development or, more generally, smart growth can create desirable, economically healthy places. This paper will discuss how smart growth can have a significant impact on the economic performance of a region.

One of the most basic problems planners face is using existing resources to manage a growing population. More specifically, planners must decide where and how much land is used and what kind of infrastructure needs to be built on that land to increase the livable capacity of a region. Ewing characterizes some sprawl-like patterns which are often used to approach this problem such as large expanses of low density or single-use development, leapfrog or scattered development, and commercial strip development (Ewing 1997) . On the other end of the spectrum, more compact development patterns focus on minimizing land-use and building livable capacity through increasing the population density of a given place. Debates have raged (Ewing 1997; Gordon and Richardson 1997) as to whether sprawl is really something to be concerned about and whether, as an alternative, compact development or, more generally, smart growth can create desirable, economically healthy places. This paper will discuss how smart growth can have a significant impact on the economic performance of a region.

Smart growth encompasses a set of planning goals and policies which emphasizes limiting outward expansion and encouraging higher density development by concentrating housing and employment (Muro and Puentes 2004) . There is also a focus on promoting mixed-use zoning, increasing accessibility for pedestrian and vehicle traffic, preserving open spaces for agricultural and park uses, and reusing and improving existing infrastructure instead of building them from scratch. Smart growth also attempts to tackle poverty and revitalize communities that have lost their vitality. Downtown areas, while providing the prototypical opportunities for smart growth, are not the only opportunities. Indeed, smart growth relevant movements such as New Urbanism have spent a great deal of effort focusing on suburban as well as urban areas.

In a time when cities are often facing financial crises, managing growth more efficiently and in a fiscally prudent manner is necessary to stimulate and sustain local and regional economies. Smart growth management practices lead to high-density, geographically compact locales which offer a number of benefits. First, high-density locales have lower per capita infrastructure costs than lower density areas which can save local governments significant amounts of capital. Second, smart growth areas often have higher property values thus increasing the local tax base. Third, the density of these areas increases the likelihood that businesses will compete and collaborate and generate new ideas and new jobs. Finally, improved economic performance in high-density urban areas can lead to better economic performance in their corresponding low density suburbs and the region as a whole.

In a time when cities are often facing financial crises, managing growth more efficiently and in a fiscally prudent manner is necessary to stimulate and sustain local and regional economies. Smart growth management practices lead to high-density, geographically compact locales which offer a number of benefits. First, high-density locales have lower per capita infrastructure costs than lower density areas which can save local governments significant amounts of capital. Second, smart growth areas often have higher property values thus increasing the local tax base. Third, the density of these areas increases the likelihood that businesses will compete and collaborate and generate new ideas and new jobs. Finally, improved economic performance in high-density urban areas can lead to better economic performance in their corresponding low density suburbs and the region as a whole.

Smart growth management practices lead to compact, high density population centers which gain fiscal advantages in two different ways. The first savings is through economies of scale where the marginal costs of serving additional population decreases as more residents cluster in a given region. The second fiscal savings is through economies of geographic scope where the marginal costs of serving an additional person decreases as the individual locates closer to existing infrastructure. Together, these ideas imply that both compact and high density communities can lead to significant savings in operational costs. In 1999-2000, localities spent nearly $140 billion to create new infrastructure such as schools, roads, and sewer and utility systems. In addition, over $200 billion was spent on recurring costs such as infrastructure maintenance, police and fire services, and garbage collection (Muro and Puentes 2004) . Managing this growth in an intelligent way provides an opportunity for significant savings fr local municipalities. Several studies claim that over 2000-2025, governments practicing managed growth can reduce by 11.8% or $110 billion their road building costs, 6% or $12.6 billion dollars on water and sewer costs, and 3.7% or $4 billion for recurring annual operations and maintenance costs (Muro and Puentes 2004) .

In addition to saving the government money through infrastructure costs, smart growth practices can also make the government money through increases in property values. Several studies make the claim that housing that is geographically contained results in higher housing prices, though the studies differ in the reasons they offer for that increase (Katz and Rosen 1987; Nelson 2000) . Some claim that the reason for the increased property values is the lack of housing supply while others credit enhanced convenience, walkability, public transport, and lower service costs. In either case, whether limiting land use or in increased the desirability of a given place, the resulting property value appreciation enhances the local government’s tax base.

Mounting empirical evidence confirms the link between compact, high-density development and economic vitality. Ciccone and Hall (Ciccone and Hall. 1996) have studied how density influences worker productivity and have shown that doubling employment density increases worker productivity by 6%. Furthermore, they report that workers in the 10 densest states generated $38,782 of value while workers in the 10 least dense states produced $31,578 (25% less).

A study by Cervero (Cervero 2000) showed that accessible cities, one’s with efficient transportation and where businesses have easy access to labor markets, employed more productive workers than dispersed or less accessible cities. This is further supported by the Surface Transport Policy Project (http://www.transact.org/library/factsheets/prosperity.asp) which claims both that long commute times can decrease productivity through time wasted behind the wheel in traffic. They cite that, as of 1995, the average American spends 443 hours or 55 8-hour workdays commuting (for some perspective, compare that to 20 or so days of vacation the average salaried American is granted each year). STPP also claims that since employees are now beginning to recognize the difficulties of commuting and choosing jobs which are more accessible, employers ignoring these trends may have a more difficult time recruiting employees.

A study by Cervero (Cervero 2000) showed that accessible cities, one’s with efficient transportation and where businesses have easy access to labor markets, employed more productive workers than dispersed or less accessible cities. This is further supported by the Surface Transport Policy Project (http://www.transact.org/library/factsheets/prosperity.asp) which claims both that long commute times can decrease productivity through time wasted behind the wheel in traffic. They cite that, as of 1995, the average American spends 443 hours or 55 8-hour workdays commuting (for some perspective, compare that to 20 or so days of vacation the average salaried American is granted each year). STPP also claims that since employees are now beginning to recognize the difficulties of commuting and choosing jobs which are more accessible, employers ignoring these trends may have a more difficult time recruiting employees.

Nelson and Peterman (Nelson and Peterman 2000) showed that cities that use growth management techniques, such as urban growth boundaries, urban service limits, or regionalized planning, can improve their economic performance, as measured by personal income, relative to cities which do not manage their growth. The authors tie the improved economic performance to taxpayer savings, efficiency gains, and quality-of-life improvements.

Finally, Carlino (Carlino 2001) also links denser local economies with increasing patent activity. He reports that the number of patents per capita rose 20-30% for every doubling of density which in turn increases the competitiveness of denser regions over less dense regions.

There is some evidence to suggest that the economic benefits of smart growth extend beyond the locales in which smart growth has occurred and improve the performance of surrounding low-density suburbs and thus the region as a whole. Voith (Voith 1998) measured patterns of growth in income, housing prices, and population in cities and suburbs in most major metropolitan areas and found that an increase in city income positively affects the wealth of the surrounding suburban regions both with respect to personal income and with respect to housing prices. He specifically looked at the city of Philadelphia and calculated that a 1% increase in the city income rate would result in a total benefit (suburban income plus housing appreciation) of 2.8 percent. Additionally, Pastor and his colleagues found that in 74 metropolitan areas, reduction in central poverty rates resulted in income growth across the region. Both of these findings suggest that smart growth’s initiatives to revitalize inner cities and to tackle poverty can have a significant impact on the economic performance of surrounding areas.

Though the evidence supporting smart growth is growing, there is also some evidence which suggests that not all of its effects are positive. In particular, smart growth policies have sometimes come under criticism for leading to gentrification. A 2002 study by the National Center for Public Policy Research (http://www.nationalcenter.org/NewSegregation.pdf) used Portland, Oregon as a baseline example of smart growth and found that if Portland-style policies had been adopted nationally 10 years earlier, then 260,000 minority homeowners would not own their homes currently, 1 million homeowners of all races would not own their homes currently, the average home price would increase by $10,000 (in 2002 dollars), and the average cost of renting a home or apartment would increase 6 percent. Along the same lines, Gordon and Richardson (Gordon and Richardson 1997) describe many smart growth inspired communities such as Laguna West, Kentlands, and Seaside which are far less affordable that typical suburban properties.

Though the evidence supporting smart growth is growing, there is also some evidence which suggests that not all of its effects are positive. In particular, smart growth policies have sometimes come under criticism for leading to gentrification. A 2002 study by the National Center for Public Policy Research (http://www.nationalcenter.org/NewSegregation.pdf) used Portland, Oregon as a baseline example of smart growth and found that if Portland-style policies had been adopted nationally 10 years earlier, then 260,000 minority homeowners would not own their homes currently, 1 million homeowners of all races would not own their homes currently, the average home price would increase by $10,000 (in 2002 dollars), and the average cost of renting a home or apartment would increase 6 percent. Along the same lines, Gordon and Richardson (Gordon and Richardson 1997) describe many smart growth inspired communities such as Laguna West, Kentlands, and Seaside which are far less affordable that typical suburban properties.

Gordon and Richardson also dispute the claim that compact cities benefit from efficiencies of scale. They show that the relationship between municipal costs savings through efficiencies increases only up to a certain population density after which it goes down. Furthermore, they claim that the costs of congestion are worthwhile only if communication and transportation costs are high and since those costs have been steadily decreasing, the benefits of a compact settlements are becoming marginalized. Finally, Gordon and Richardson also claim that declining sectors often use public monies in an effort to revitalize their areas (for example TIFs, brownfield redevelopment, renaissance zones) and that often those efforts fail. They characterize Los Angeles's 25 year $2.5 billion expenditure for downtown revitalization as a failure in particular because its tax increment revenues are not sufficient to support further revitalization.

Smart Growth America (www.smartgrowthamerica.org) cites housing, economy, children & schools, environment, preservation & revitalization, social equity, transportation, open space & farmland, and health & aging as issues which it deems to be important. As of yet, much of the empirical evidence for the economic benefits of smart growth focuses on density and compactness. These, while being important and useful variables, do not encompass the wide-ranging initiatives of smart growth and may not be the only or primary reasons for its economic benefits. In Lost Landscapes and Failed Economies, Powers (Power 1996) emphasizes the importance of intangibles, such as vitality, which contribute to the value of given place which in turn supports economic strength. One of the worker productivity studies described earlier (Nelson and Peterman 2000) also hints that quality of place might play a large role in worker productivity. Unfortunately, the relationship between density/compactness and the quality of place is not clear. Additionally, the oft-used measure of net personal income is a broad, averaging measure that washes over equity related issues such as gentrification which are common in compact and dense areas. All of this suggests that a more careful analysis needs to be done as to how and under what conditions smart growth is beneficial. But given current times in which financial crises are common for many local governments, the potential fiscal efficiency of smarter growth should be reason enough for its consideration.

Carlino, G. (2001). Knowledge Spillovers: Cities’ Role in the New Economy. Business Review. Q4: 17-24.

Cervero, R. (2000). Efficient Urbanization: Economic Performance and the Shape of the Metropolis, Lincoln Institute of Land Policy.

Ciccone, A. and R. E. Hall. (1996). "Productivity and the Density of Economic Activity." American Economic Review 86(1): 54-70.

Ewing, R. (1997). "Is Los Angeles-Style Sprawl Desirable?" Journal of the American Planning Association 63(1): 107-126.

Gordon, P. and H. Richardson (1997). "Are Compact Cities a Desirable Planning Goal?" Journal of the American Planning Association 63(1): 95-106.

Katz, L. and K. T. Rosen (1987). "The Interjurisdictional Effects of Growth Controls on Housing Prices." Journal of Law and Economics 30: 146-160.

Muro, M. and R. Puentes (2004). Investing in a Better Future: A Review of the Fiscal and Competitive Advantages of Smarter Growth Development Patterns, The Brookings Institution Center on Urban and Metropolitan Policy.

Nelson, A. C. (2000). Effects of Urban Containment on Housing Prices and Landowner Behavior. Cambridge, MA, Lincoln Institute of Land Policy.

Nelson, A. C. and D. Peterman (2000). "Does Growth Management Matter: The Effect of Growth Management on Economic Performance." Journal of Planning Education and Research 19: 277-285.

Power, T. M. (1996). Lost landscapes and failed economies: the search for a value of place. Washington, D.C., Island Press.

Unknown (2002). Smart Growth and its Effects on Housing Markets: The New Segregation, The National Center for Public Policy Research.

Voith, R. (1998). "Do Suburb Need Cities?" Journal of Regional Science 28(3): 445-464.

Sprawl: http://www.csmonitor.com/slideshows/durableSlideshows/suburbanSprawl/slide1.html

Smart Growth: http://www.smartgrowthamerica.org/images/economypic.jpg

Traffic Jam: http://www.civiccomputing.com:8080/travel_awareness/images/Traffic%20jam%20thumb.jpg

Seaside: http://www.seasidefl.com/images/realEstate/1026_1044.jpg